One of the few popular investing alternatives today is mutual funds. Since mutual funds give millennials the much-needed flexibility of making small, regular investments, they are becoming more and more popular. The next question that comes up after learning that you may make tiny investments is "how much of my pay should be placed in mutual funds?" In this post, we discussed the following topics:

Table of contents

50:30:20 Rule

The Value of Mutual Fund Investments

Long-Term Strategy

Conclusion

50:30:20 Rule

Every earner should be required to include the 50:30:20 guideline into their financial strategy. This is crucial, especially for those who provide for their families. Their future will be great if this guideline is followed. According to the 50:30:20 guideline, you should spend 50% of your income on needs, 30% on wants, and the remaining 20% on saving money for emergencies.

The items that are required for maintaining daily living are considered needs. These include of things like food, utilities, and rent or mortgage payments. You cannot avoid meeting needs, thus you must spend money on them. Even when they are not technically necessary, wants are items you use to improve your quality of life. Vacations, movie tickets, gym memberships, internet streaming site subscriptions, and other expenses fall under this category. Anyone should make an effort to spend as little money as possible on wishes.

The remaining 20% of your income must be placed away in order to build an emergency fund that is at least three times your monthly salary. When it is over, you may begin investing. Therefore, you should invest 20% of your monthly income in mutual funds. If you can cut back on your demands, you may use the additional cash to increase your mutual fund investments.

Importance of Investing in Mutual Funds

Mutual funds attract millennial investors because they provide much-needed flexibility. Periodically, one can invest a modest sum. However, this is not the only reason why mutual funds are so well-liked right now. One of the few types of investments that has the potential to deliver returns that outpace inflation is mutual funds.

Over time, inflation will lower the value of your money or investment. After five years, a product that costs Rs 100 now may cost Rs 175 instead. If your investment doesn't provide returns that outpace inflation, inflation at an annual rate of 8% will consume half of it in eight years. The table below displays how your investment of Rs. 1,000,000 has been affected by inflation (8%):

Long Term Planning

Mutual funds may be a huge asset when it comes to future planning. In reality, maintaining your investment for a long time is the greatest way to use mutual funds (five years or more). Investors should expect good long-term returns thanks to the power of compounding and a long investment horizon. Mutual funds can generate returns in the region of 15% to 18% when the markets are favourable.

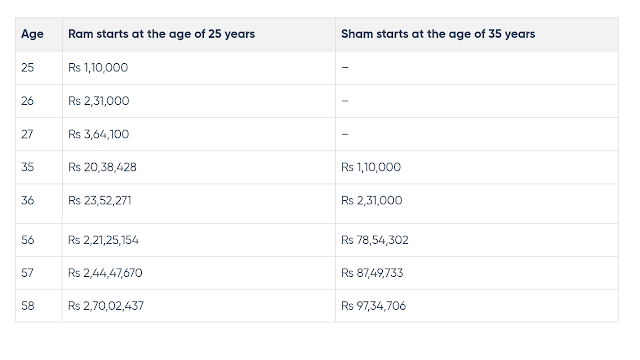

Let's use the friendship between Ram and Sham as an example. At the age of 25, Mr. Ram begins investing Rs. 1,000,000 annually in mutual funds. At the age of 35, Mr. Sham begins investing in the same mutual funds. Let's assume that the plan offers a 10% yearly interest rate. At the age of 58, Ram and Sham both made the decision to cash out their investment. The difference in the total accumulated by Ram and Sham is displayed in the following table:

Age At the age of 25, Ram begins. At the age of 35, sham begins.

Note: The annual corpus is increased by the power of compounding. The figures in the previous table do not represent all of the computations.

Conclusion

The 50:30:20 guideline must be used to your financial strategy. One should put at least 20% of their income into mutual funds, and they should raise as much as they can. In order to avoid their investment losing value over time, investors must now consider choices like mutual funds due to the impact of inflation.