Both the National Pension Scheme (NPS) and the Public Provident Fund (PPF) are supported by the government. They both advise you to routinely save money to ensure your quality of life after retirement. But why are there two plans with comparable objectives? What distinguishes them from one another? Which one of them ought you to pick?

We can assist if you find yourself in the NPS vs. PPF argument. For better investment planning, you may learn more about NPS and PPF in this article.

NPS vs PPF?

Yes, this is a challenging question. First and foremost, the Public Provident Fund (PPF) comes to mind whenever we consider investing for a post-retirement fund. PPF is a fantastic investment option for long-term savings since it offers safe returns over the long term and for all ages.

However, the National Pension Scheme, or NPS, has recently drawn a lot of attention as a method for saving for retirement. After the Budget 2015–16, when the government announced an extra tax deduction of Rs. 50,000 for NPS investments, the use of NPS has expanded.

But which of them should you choose if you could only pick one? In this post, we want to provide an answer to that query.

Understanding PPF

PPF is a well-established government-funded investment programme that has gained favour with investors that have a lengthy time horizon for their investments. One must invest in the programme for 15 years to get the greatest outcomes!

The PPF account could not previously be prematurely closed, but this function has recently been added under the condition that the account holder maintain the PPF account open for a minimum of five years before shutting it.

Premature closure will only be permitted under the following situations:

- purchasing a higher education, or

- to cover medical costs (in case of life-threatening diseases and supported by documents from a medical practitioner)

Before opening a PPF account, you should also be aware of the following:

- Currently, PPF interest rates hover around 7.1% p.a. Each year, interest is compounded

- Every year on March 31st, the account gets credited with interest.

- Because interest is computed on the lowest amount retained, deposits should be made between the first and fifth of the morning to receive the most interest (i.e. the amount held on the 5th)

- When you have held it for a minimum of three years, you can even take out a loan against your PPF account. You can be qualified for another loan if you pay off the loan in full before the sixth year.

Who can invest in PPF?

PPF investments are open to all Indian citizens. Unless the second account is in the name of a minor, a citizen is only permitted to have one PPF account. A PPF account cannot be opened by NRIs or HUFs.

Understanding NPS

After learning the fundamentals of PPF, let's examine the NPS (National Pension Scheme) as well. Employees from the public, private, and unorganised sectors are eligible for the government-sponsored National Pension Scheme (except for the armed forces).

Through the duration of their work, account holders in this system can make regular contributions to a pension account. The account holders may spend a portion of the corpus as a lump payment and the remaining balance as a pension once they retire.

Who can invest in NPS?

Any Indian citizen who is between the ages of 18 and 60 on the application submission date is eligible to apply for the NPS. The account holder must adhere to the Know Your Customer (KYC) guidelines and cannot be an unsolved insolvent or be under the influence of drugs or alcohol.

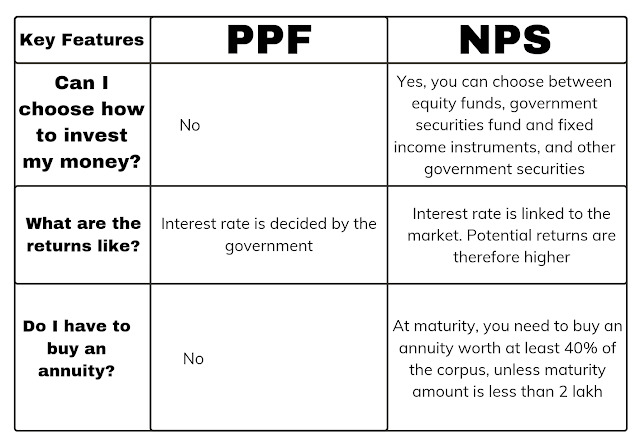

Key differences between NPS and PPF

As you can see, NPS is a fantastic way to save for retirement. If your goal is to save money for other things, like your children's school or your daughter's wedding, it might not be the greatest investment strategy. PPFs outperform NPSs as the optimal investing strategy for all of these requirements.

Tags

Mutual Funds